All Categories

Featured

Table of Contents

On the other hand, if a customer requires to offer a special requirements kid who may not be able to handle their very own money, a depend on can be included as a recipient, allowing the trustee to take care of the distributions. The sort of beneficiary an annuity owner chooses impacts what the beneficiary can do with their acquired annuity and how the profits will be taxed.

Several contracts allow a spouse to identify what to do with the annuity after the proprietor dies. A partner can transform the annuity contract right into their name, assuming all rules and rights to the initial contract and postponing prompt tax obligation consequences (Annuity investment). They can gather all remaining settlements and any type of survivor benefit and pick recipients

When a spouse ends up being the annuitant, the partner takes over the stream of settlements. Joint and survivor annuities likewise allow a called recipient to take over the agreement in a stream of settlements, instead than a lump sum.

A non-spouse can just access the assigned funds from the annuity owner's preliminary arrangement. In estate preparation, a "non-designated recipient" refers to a non-person entity that can still be called a recipient. These consist of counts on, charities and various other organizations. Annuity owners can choose to assign a trust fund as their beneficiary.

What is an Lifetime Income Annuities?

:max_bytes(150000):strip_icc()/Immediate-variable-annuity.asp-final-c62d88ef3f7a4b688c0303ef04e1fbce.png)

These differences mark which recipient will get the whole death benefit. If the annuity owner or annuitant dies and the main recipient is still alive, the primary recipient obtains the survivor benefit. However, if the key beneficiary predeceases the annuity proprietor or annuitant, the survivor benefit will certainly go to the contingent annuitant when the proprietor or annuitant passes away.

The proprietor can alter recipients at any moment, as long as the contract does not require an irrevocable recipient to be named. According to professional factor, Aamir M. Chalisa, "it is necessary to recognize the value of designating a recipient, as picking the wrong beneficiary can have serious effects. Most of our clients choose to name their minor kids as beneficiaries, frequently as the main beneficiaries in the lack of a partner.

Proprietors who are wed need to not presume their annuity immediately passes to their spouse. When selecting a beneficiary, take into consideration variables such as your connection with the person, their age and how acquiring your annuity might affect their monetary situation.

The beneficiary's partnership to the annuitant normally figures out the guidelines they comply with. For instance, a spousal recipient has even more options for handling an inherited annuity and is dealt with more leniently with tax than a non-spouse beneficiary, such as a child or other relative. Flexible premium annuities. Mean the owner does determine to name a child or grandchild as a beneficiary to their annuity

Why is an Flexible Premium Annuities important for long-term income?

In estate planning, a per stirpes designation defines that, must your recipient pass away before you do, the recipient's offspring (kids, grandchildren, et cetera) will certainly obtain the survivor benefit. Get in touch with an annuity specialist. After you've picked and called your recipient or recipients, you need to proceed to examine your choices at the very least annually.

Keeping your classifications as much as date can ensure that your annuity will certainly be managed according to your dreams should you die unexpectedly. Besides an annual evaluation, significant life occasions can motivate annuity proprietors to take another appearance at their beneficiary choices. "Someone could desire to upgrade the beneficiary designation on their annuity if their life circumstances change, such as getting married or separated, having kids, or experiencing a death in the household," Mark Stewart, Certified Public Accountant at Action By Step Organization, informed To change your recipient classification, you have to connect to the broker or representative who handles your contract or the annuity service provider itself.

What does an Senior Annuities include?

Similar to any kind of economic item, seeking the assistance of an economic expert can be helpful. A financial coordinator can guide you through annuity management processes, consisting of the methods for updating your contract's beneficiary. If no recipient is named, the payout of an annuity's fatality benefit goes to the estate of the annuity holder.

To make Wealthtender complimentary for viewers, we gain cash from advertisers, consisting of monetary experts and companies that pay to be featured. This produces a problem of interest when we favor their promo over others. Wealthtender is not a customer of these economic solutions companies.

As a writer, it is just one of the very best praises you can provide me. And though I really appreciate any of you spending several of your active days reading what I compose, slapping for my write-up, and/or leaving appreciation in a remark, asking me to cover a subject for you really makes my day.

It's you claiming you trust me to cover a topic that is necessary for you, which you're confident I would certainly do so much better than what you can already find on the Internet. Pretty spirituous things, and a duty I don't take most likely. If I'm not knowledgeable about the topic, I investigate it on-line and/or with contacts that know even more concerning it than I do.

Is there a budget-friendly Senior Annuities option?

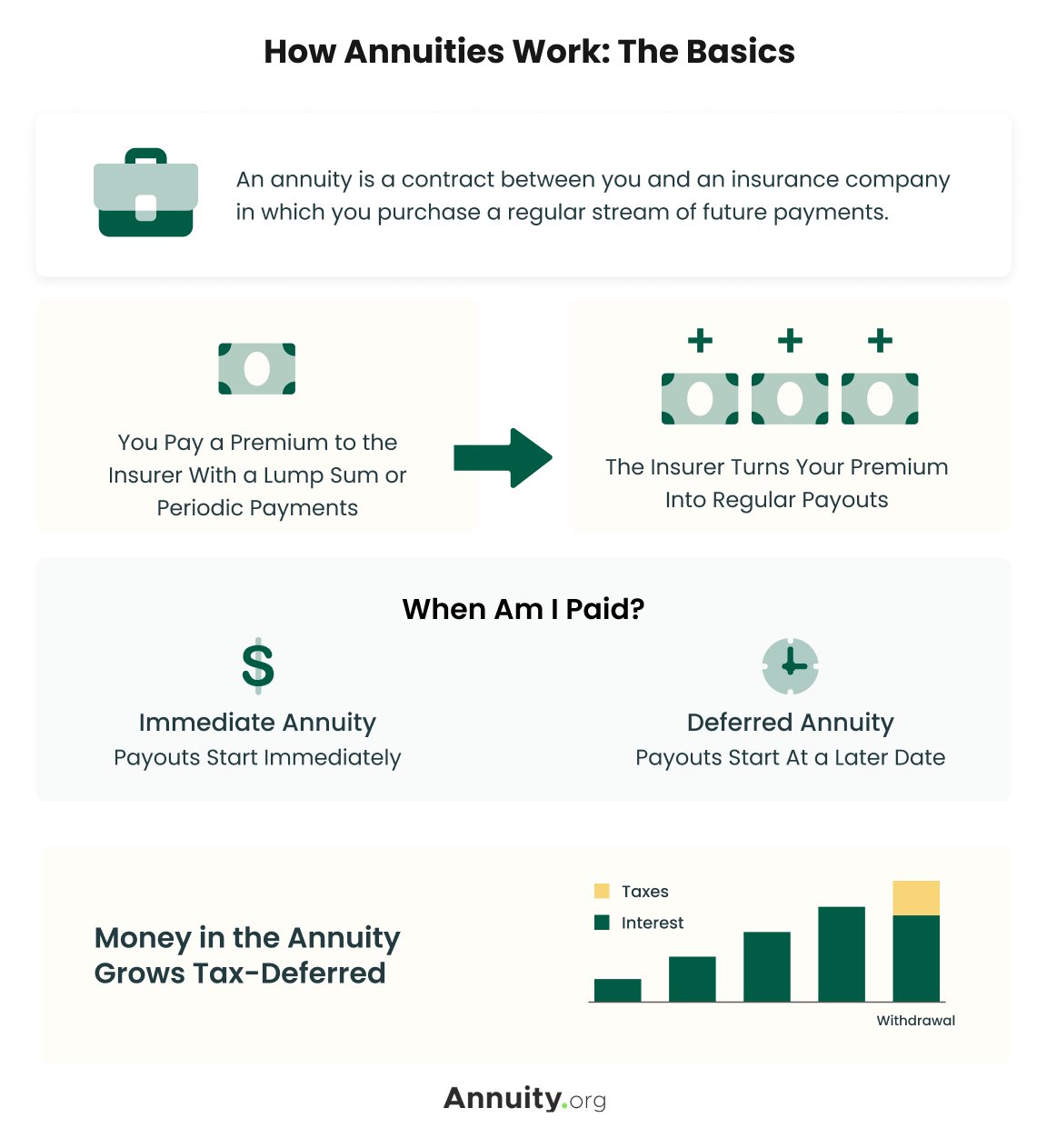

Are annuities a valid suggestion, an intelligent move to secure surefire revenue for life? In the simplest terms, an annuity is an insurance coverage item (that just certified agents might offer) that ensures you monthly repayments.

This usually uses to variable annuities. The even more riders you tack on, and the much less threat you're eager to take, the reduced the repayments you ought to anticipate to receive for a provided premium.

How do Lifetime Payout Annuities provide guaranteed income?

Annuities chose properly are the ideal selection for some people in some situations. The only means to know for certain if that includes you is to initially have a comprehensive economic strategy, and afterwards identify if any kind of annuity alternative offers sufficient benefits to warrant the costs. These costs include the bucks you pay in costs obviously, but also the chance price of not spending those funds in a different way and, for a lot of us, the influence on your eventual estate.

Charles Schwab has an awesome annuity calculator that shows you about what settlements you can get out of taken care of annuities. I made use of the calculator on 5/26/2022 to see what a prompt annuity may payout for a solitary costs of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options A Closer Look at Variable Annuity Vs Fixed Annuity What Is the Best Retirement Option? Pros and Cons of Fixed Income Annuity Vs Variable Annuity Why Deferred

Exploring Fixed Index Annuity Vs Variable Annuities A Comprehensive Guide to Immediate Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity Breaking Down the Basics of Investment Plans Advantages and Disadv

More

Latest Posts